Tax season is already painful enough for most Americans.

The federal government wants to add to the country’s misery.

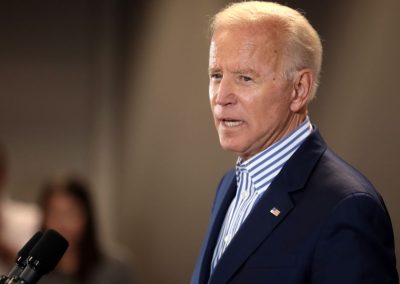

Now Florida is trying to stop this blunder by Joe Biden from punching taxpayers in the gut.

Democrats like U.S. Senator Elizabeth Warren have had an ax to grind with tax preparation software like TurboTax because it’s a for-profit business.

That is why she’s been pushing for the IRS to set up its own free software for Americans to use to file their taxes.

After the debacle of setting up the Obamacare website, many critics were wary of the IRS attempting to get into the tax software.

Free options already exist for taxpayers to file their returns, but Democrats insist on creating another expensive and unnecessary government program.

IRS creates a broken version of TurboTax

Treasury Secretary Janet Yellen directed the IRS to create the IRS Direct File program with money from the wildly misnamed Inflation Reduction Act to allow taxpayers to use the government-created program to file their income taxes.

Direct File is currently a pilot program and is expected to cost more than $2.5 billion over the next decade.

Launched in January, it is available in 12 states so far and is meant to copy the experience of programs like TurboTax and H&R Block.

But 18 Republican state financial officers say that Direct File is doing more harm than good, and they sent a letter to Yellen urging her to shut the program down.

“Regrettably, Direct File is a solution in search of a problem,” the state financial officers wrote. “Direct File has the potential to do more harm than good for taxpayers. It will only enable them to file their federal tax returns. Taxpayers who are unaware that they must separately file state returns will not receive anticipated state refunds this spring.”

IRS tax return software could hurt low-income Americans

Direct File does not have an option to file state income taxes, which could leave some people with a nasty surprise.

“This is significant because many taxpayers who use Direct File are likely to be lower-income and build budgets around anticipated tax refunds,” the letter added. “Even worse, confused taxpayers who neglect to file their state returns will be at risk of incurring state penalties. Imagine the surprise to the taxpayer who becomes subject to audit by the IRS after having filed through Direct File and having felt assurances that the tax return was prepared properly through the IRS’s own system.”

The state financial officers said that low-income or elderly users could be misled because the Direct File program does not tell them they need to file state income taxes.

“Surely a better use of taxpayer funds would be for the IRS to boost existing marketing efforts, or undertake new marketing efforts, for existing low- and no-cost tax preparation options rather than try to build a flawed service with the potential to harm those it seeks to help,” the letter concluded.

“Again, we urge you to shut down Direct File. We appreciate your attention to this important matter to protect taxpayers.”

State financial officers and treasurers from Alaska, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Nebraska, North Carolina, Ohio, Oklahoma, South Carolina, South Dakota, Utah, West Virginia, and Wyoming are taking part in the effort.

The IRS is wasting taxpayer money on a program no one asked for besides a handful of left-wing activists.

DeSantis Daily will keep you up-to-date on any developments to this ongoing story.